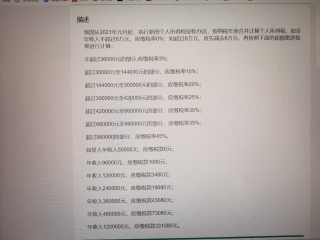

java求个人所得税,代码正确但不完全符合题目

import java.util.Scanner ;

public class tax{

public static void main(String[ ] args){

Scanner in = new Scanner(System.in);

int t=in.nextInt( );

int ans;

if(t<=60000){

System.out.println("0");}

else if(t>60000){

if((t-60000)<=36000){

ans=(int)((t-60000)*0.03);

System.out.printf("%d",ans);}

else if((36000<(t-60000)) && ((t-60000)<=144000)){

ans=(int)((t-60000)*0.1);

System.out.printf("%d",ans);}

else if((144000<(t-60000)) && ((t-60000)<=300000)){

ans=(int)((t-60000)*0.2);

System.out.printf("%d",ans);}

else if((300000<(t-60000)) && ((t-60000)<=420000)){

ans=(int)((t-60000)*0.25);

System.out.printf("%d",ans);}

else if((420000<(t-60000)) && ((t-60000)<=660000)){

ans=(int)((t-60000)*0.3);

System.out.printf("%d",ans);}

else if((660000<(t-60000)) && ((t-60000)<=960000)){

ans=(int)((t-60000)*0.35);

System.out.printf("%d",ans);}

else if((t-60000)<960000){

ans=(int)((t-60000)*0.45);

System.out.printf("%d",ans);}

} } }

看来你不是很懂税是怎么交的,题目其实说的也很清楚了,这是需要分段来算的。

如题中的240000年收入:

240000 - 60000 = 180000

不超过36000的部分 = 36000,应纳税 36000 * 0.03 = 1080

超过36000至144000的部分 = 144000 - 36000 = 108000,应纳税 108000* 0.1 = 10800

超过144000至300000的部分 = 180000- 144000 = 36000,应纳税 36000 * 0.2 = 7200

三部分加起来就是你的纳税金额 = 1080 + 10800 + 7200 = 19080